When a business doesn’t understand its customer acquisition cost, it’s flying blind. Spending can quickly get out of control on low-ROI marketing efforts. Worse, most business leaders vastly underestimate or overestimate CAC. That leads them to make poor spending decisions.

Yes—CAC = MARKETING SPEND / # OF CUSTOMERS ACQUIRED, but it’s not as clear cut as that. Thinking it’s that simple is where too many run into trouble.

CUSTOMER ACQUISITION COST =

MARKETING COSTS

# OF CUSTOMERS ACQUIRED

The good news?

It’s not hard to understand customer acquisition cost. With a few examples and a quick CAC formula (and handy calculator) you’ll have a firm grip on your true CAC. Ready?

This guide will show you:

- What CAC is—and isn’t.

- How to calculate customer acquisition cost (with an easy formula).

- Several clear and easy-to-follow customer acquisition cost examples.

- A cost per customer acquisition calculator you can use in a pinch.

- Average customer acquisition cost by industry.

- 10 best practices to improve your CAC fast.

Turn your website visitors into delighted customers.

What is CAC?

CAC stands for customer acquisition cost, or—what it costs your business to acquire a new customer. It reveals whether your SaaS or eCommerce business can turn a profit as you grow. But it’s not as simple as sales & marketing cost divided by the number of new customers. Time is also a big factor.

For instance, say you spend $20,000 in June on sales and marketing. That same month, you acquire 1,000 customers. The simple math says your CAC for June is $20. But that’s too simplistic. Why?

Because of time. Your 20 new customers in June may have come from efforts in April and May, when you spent $30K a month. Worse, you have to figure out customer lifetime value (in short CLV or LTV), and that unearths a whole new tangle.

What is the lifetime value of a customer?

LTV is the total revenue you’ll get from a customer before churn sets in.

But don’t worry. We’ll break this down below in easy terms.

Pro-Tip: Sometimes (Customer) Lifetime Value is abbreviated as LTV and sometimes as CLV. They are both the same thing.

Why is CAC so important?

In a nutshell, if you don’t know your customer acquisition cost, you can’t grow. Or more accurately, you’ll try to grow blindly and most likely fail. Let’s look at a nightmare scenario to see why.

Pretend you’ve got a SaaS business that makes $10 per customer per month. So far, so good. You’ve got 200 customers, so you’re pulling $2,000 a month. Great!

But can you get 500 customers? 1,000? 10,000?

You must know if your CAC is more than $10 per customer per month if you scale up. Is it? If so, your great business is a giant money pit with a tarp over it.

But you also must know how the real timeline of your CAC plays out, or you’ll be walking into a financial bear trap. Let’s see why.

Beware the underwater customer acquisition cost

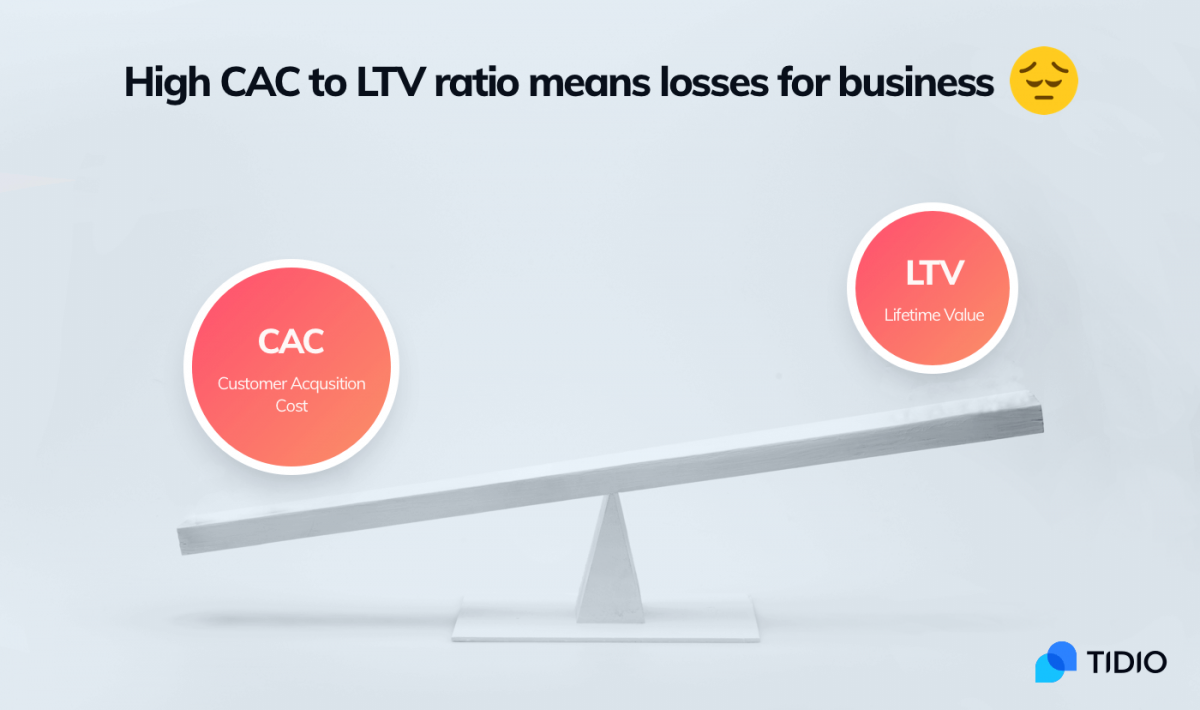

Let’s look at a couple of very different business models. Each one compares the CAC of a pretend business to the LTV (Lifetime Value) of each customer.

Out of balance CAC

It’s easy to see why that business model doesn’t fly. Scaling up that company would be disastrous.

But again, it’s oversimplified. We’ll see why in a minute. But first let’s look at an in-balance business model

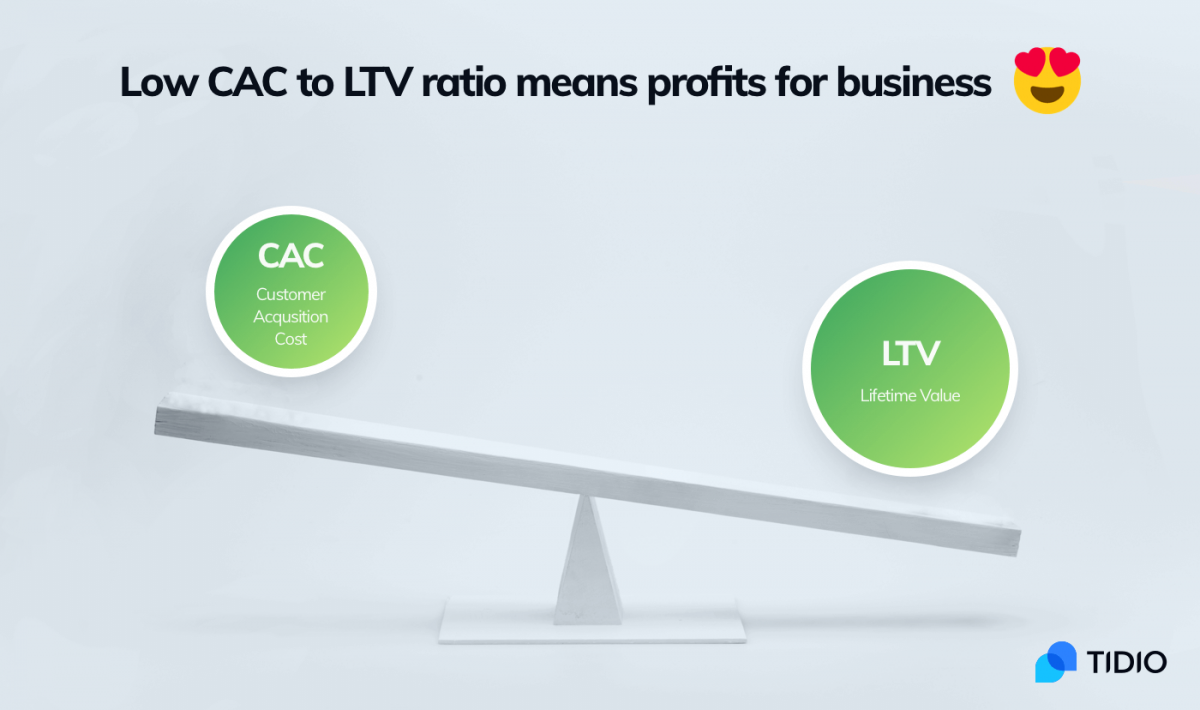

In balance CAC

That CAC to LTV ratio is much better. Should we pour money into this business? As much as we can, right?

But pump the brakes, because it’s not so simple. We need to know how to calculate CAC—but not just our CAC. We need an accurate picture of both our CAC and our modified LTV to make the best decision.

How to calculate customer acquisition cost

This is where the rubber meets the road. Of course, you know that if your CAC > LTV, your business will sink. But without a true grasp on the real, unvarnished values for both figures, you’ll still make blindfolded decisions.

So let’s get into it. There’s a little math, but it won’t hurt.

Here’s the basic customer acquisition cost formula:

CAC = Cost of Sales & Marketing/ # of New Customers

But—

Don’t use that formula. Why not?

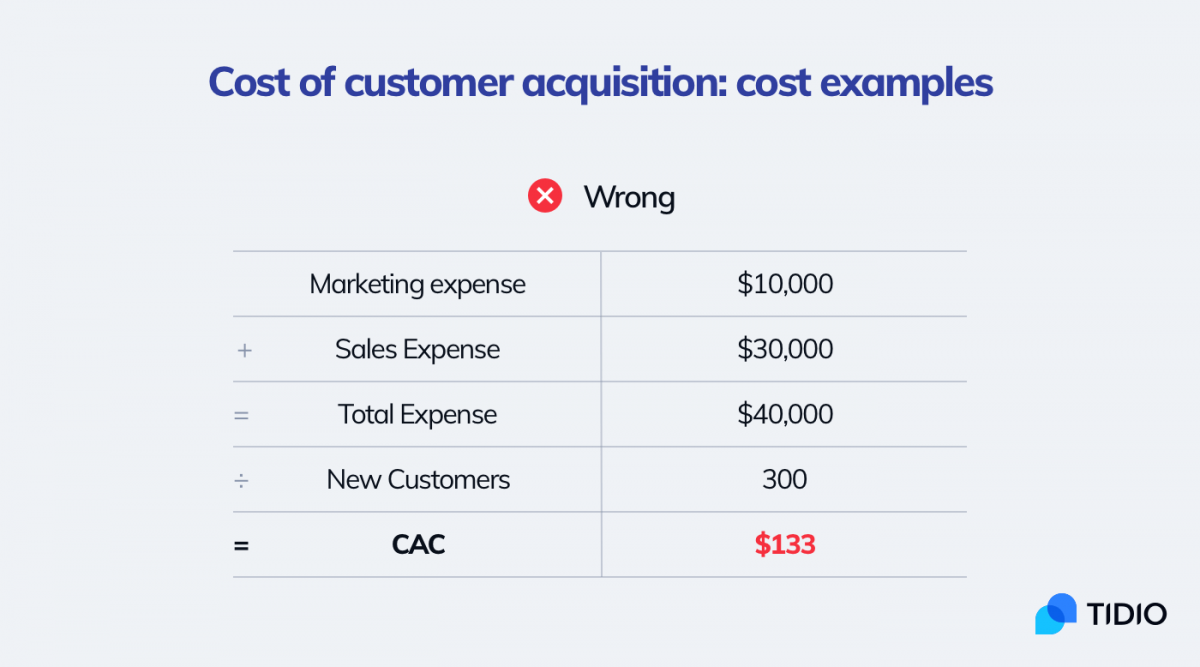

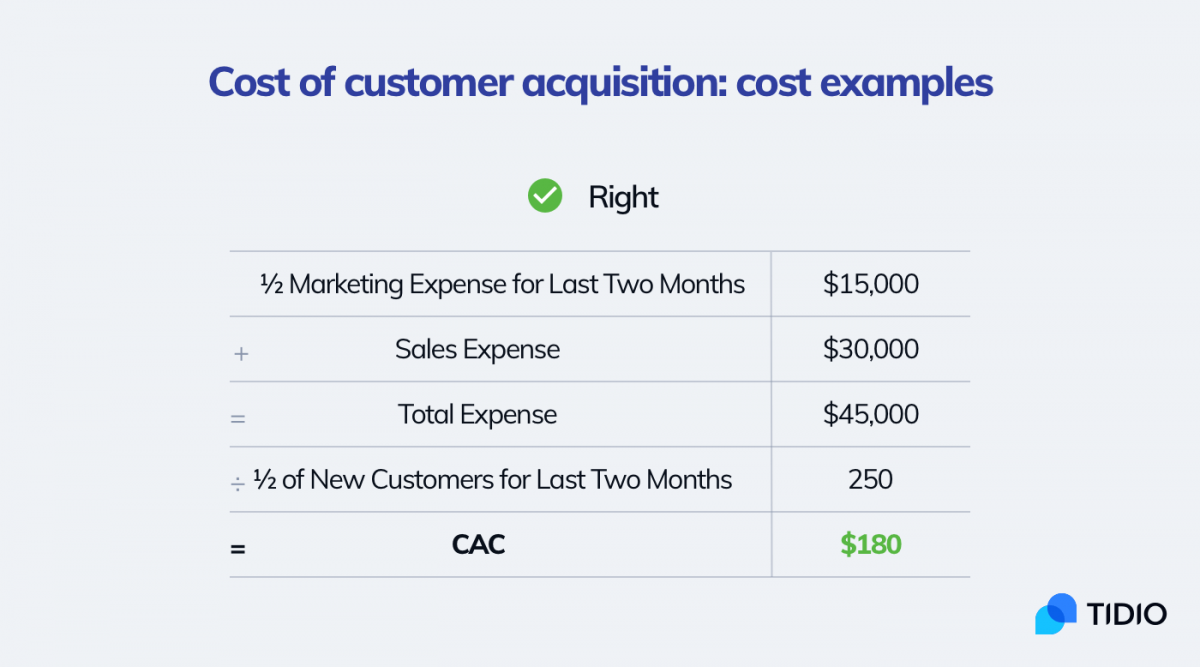

Because we still need to take time into account. Let’s look at right and wrong examples of CAC to see how it works:

Cost of customer acquisition cost examples

Why doesn’t that example work? Because dividing sales and marketing by the number of new customers ignores time.

In other words, how long does it take from the time you spend the money on a sales or marketing effort to the time you get the customer?

The example below fits better with reality:

Now we have a very different customer acquisition cost. We may not want to spend more on our current marketing plan.

This looks complex, but it’s not. The idea is that your marketing efforts from last month probably impact this month’s new customers.

Where do you draw the line? Generally, rolling in at least two months of marketing expense and new customers will give a clear picture, and 90 days is best. But we’re not finished, because we need to factor in LTV.

CAC formula with LTV

Can you scale this business up? Are your sales and marketing channels getting enough ROI? The way you learn that is by comparing the adjusted customer acquisition cost above with the lifetime value of a customer. But—again, we need the true lifetime value, and we need to tweak it.

Let’s say you have a SaaS that makes $10 per customer per month. It’s based on a subscription. You know your average customer sticks around for a year before churn hits. So your LTV = $10 x 12 = $120.

As a general rule of thumb, if your CAC is less than your LTV and you keep your customers longer than 90 days, you’re set up for success.

Put another way, if your LTV is 3x to 5x your CAC, and you’ll recover your costs in less than 12 months, you’re in the golden zone.

It’s important to recoup your CAC as fast as possible. Less time between paying and getting paid means you need less capital to operate.

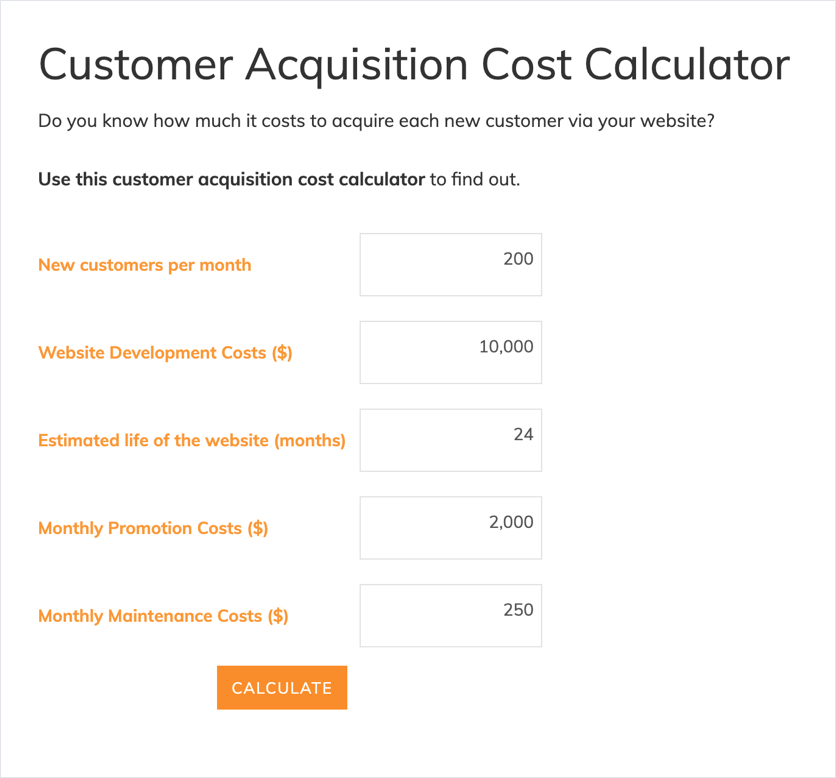

Simple customer acquisition cost calculator

Just want a quick way to figure CAC without the math? Marketing research firm Panalysis developed a simple CAC calculator online. It’s a bit simplistic in that it doesn’t spread your CAC out over a 90 day period, but you can use it to get a general idea of where you are.

It has fields for the number of new customers, web development costs, life of the website in months, and promotion and maintenance costs. But—you can input sales and marketing costs instead, and skip the other costs.

What to include in customer acquisition cost

One big mistake a lot of startups make is including the wrong costs in CAC. Sure, we want our sales & marketing costs in there, but what about web development? Payroll? Tools? Maintenance? Make sure you do the head-scratching to figure out the true cost of acquiring a customer.

Your calculation should include:

- Sales & marketing expenses. This is a no-brainer. Add in the salaries of your sales and marketing team, tools, and spend. However, subtract out the portions that don’t apply to acquiring new customers (see below).

- Part of your operating costs. Just like a trucking company can’t operate without roads, your sales & marketing teams can’t operate without business infrastructure. Allocate a portion of your IT costs, taxes, and other business costs to your CAC.

- New customers. Another easy one, but make sure not to include “customers” who haven’t yet turned into revenue.

It’s a little harder knowing what not to include in customer acquisition cost. Figuring in too much can lead you to terrible decisions. If you include the costs below, you might abandon your best channels and tools.

What not to include in CAC

- Don’t include customer success costs. We want to understand customer acquisition, so don’t confuse it with retention. (Otherwise, you can’t compare the two costs later.)

- Total salaries of salespeople who work on customer success and/or account management. Only include a weighted portion of that figure.

- Full costs of analytics and sales tools for those who don’t add new customers. Again, prorate these costs.

- Expenses for marketing and sales services you provide to customers.

- PR and branding efforts that don’t directly drive sales.

In short? Only include those portions of your costs that map directly to acquiring new customers. Take the time to think about which “sales and marketing” costs actually serve other parts of your business.

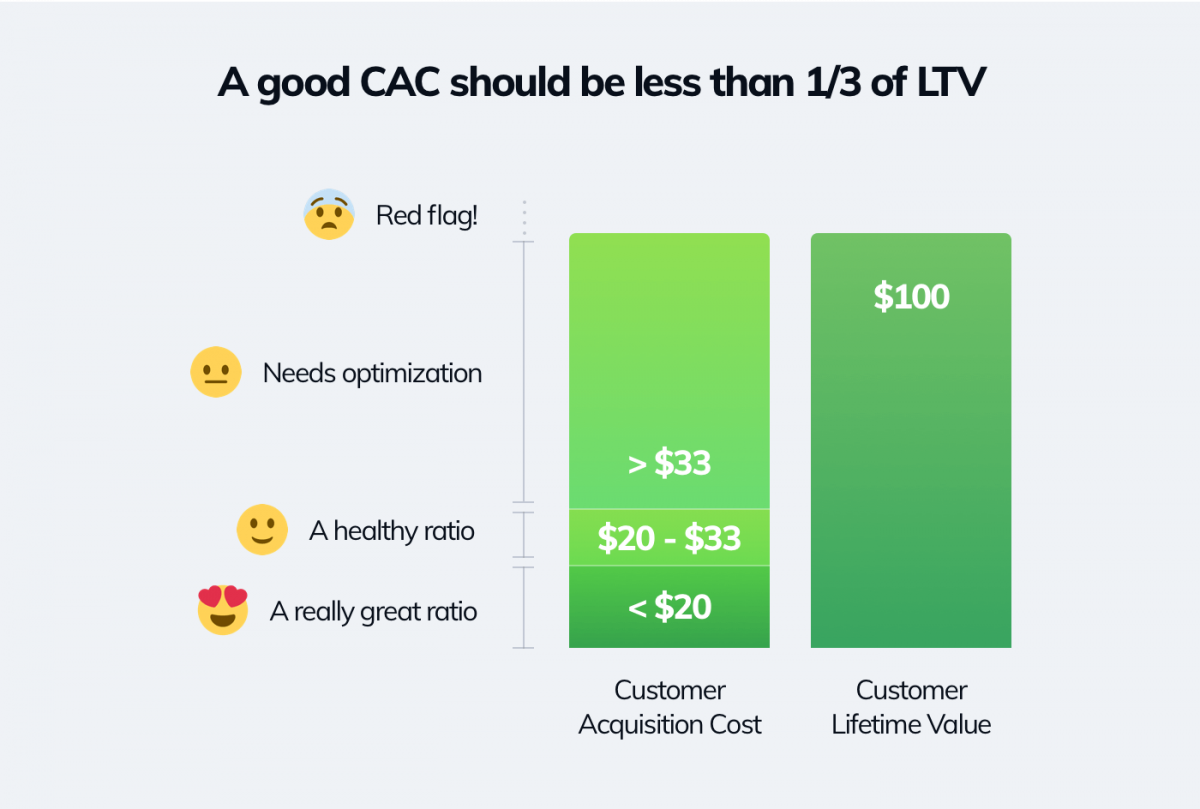

What is a good customer acquisition cost?

A “good” CAC depends on the lifetime value (LTV) of your customer. Generally, a customer acquisition cost that will make a business profitable is ⅓ to 1/5 of the LTV. That way, you cover your sales and marketing costs and operating costs and have enough left over for a profit.

CAC per marketing channel

Where should you spend more? Less?

It would be nice to know the customer acquisition cost of each marketing channel to learn the best use of your budget.

You can break out different marketing channel costs on each month’s spreadsheet. How much did you spend on pay-per-click? On content marketing?

The problem? There’s no way to find out how many customers you generate from every channel. For some channels like content marketing or pay-per-click, you can track sales directly from on-page CTAs or Google Analytics.

But what about top-of-funnel content, radio and TV ads, and other non-trackable marketing channels? Those don’t lend themselves to dialed-in KPIs.

Average customer acquisition cost by industry

Need a benchmark to see if your CAC measures up to successful companies in your industry? No “average cost” can fully guide your spends. But let’s take a look at how some industries shake out.

Different industries have different sales cycles, purchase frequency, and purchase value, and different customer lifespans. Let’s see some CAC values based on research:

- Ecommerce: $88

- Travel: $7

- Retail: $10

- Financial: $175

- Telecom: $315

- Consumer Goods: $22

- Transportation: $98

- Technology Hardware: $182

- Software: $395

- Banking: $303

- Marketing Agency: $141

- Real Estate: $213

- Manufacturing: $83

- Transportation: $98

How to improve CAC

If you can’t lower your customer acquisition cost below the lifetime value of a customer, you can’t scale up. Even if you can lower it, the most profitable CAC ratio will be about ⅓ to 1/5 your LTV. By contrast, companies that shrink their CAC can increase profit. It’s not rocket science.

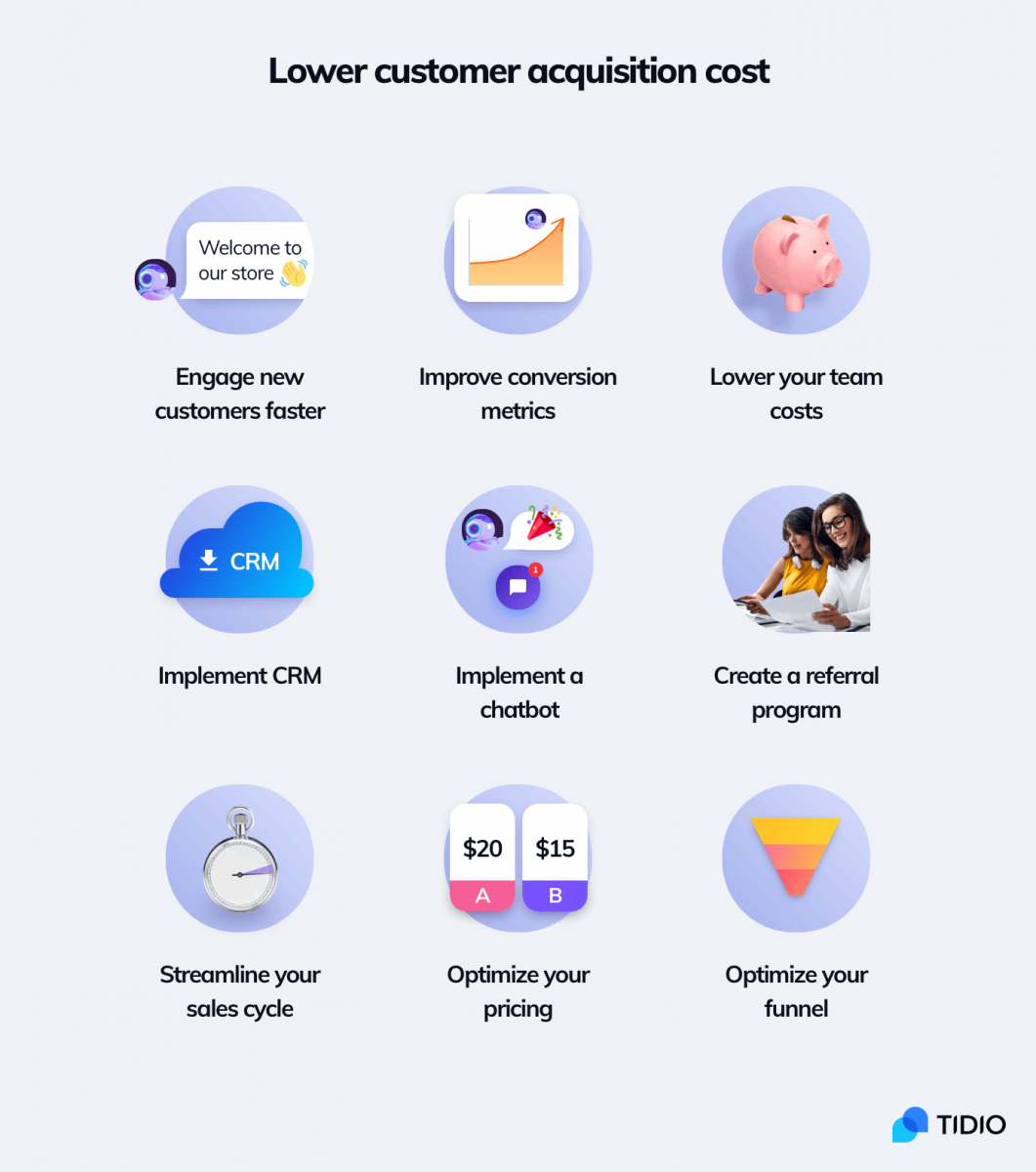

There are several ways to lower customer acquisition cost:

- Engage new customers faster. The quicker you engage new customers and leads, the better your odds of turning them into sales. The average lead response time is 42 hours, according to the Harvard Business Review. But a study by LeadResponseManagement.org found cutting that to 5 minutes created a 100x boost in connection rate and a 21x jump in the number of qualified leads.

- Improve conversion metrics. Naturally, increasing conversions cuts the CAC per customer. When you spend the same money to get more customers, your per-customer acquisition cost goes down. You can do that by creating clear website copy, optimizing your site for shopping and mobile form submissions, and installing a chatbot.

- Lower your team costs. The average live inbound call from a customer with a question costs more than $15. When a percentage of your customers call before they buy, cutting down on those calls can slash your CAC.

- Implement a chatbot. Chatbots are a cheap, easy way to lower customer acquisition cost. That’s because chatbots are proven to increase conversion rate by as much as 30%. They simultaneously cut per-customer call cost from $15 to $1. They also collect valuable customer feedback and provide 24/7 sales support, stopping customers from hunting elsewhere. All these functions cut your CAC.

- Increase value. Collect feedback from customers to learn what’s most important to them. Do they want new features, fixes, or discounts on certain products? Find out, and give them more of what they want to increase word of mouth and sales.

- Create a referral program. Your customers know others like them who may be warm leads. Referrals have a through-the-floor customer acquisition cost of $0. Building a strong customer referral program can lower your average CAC in a hurry.

- Streamline your sales cycle. Decrease the time between paying and getting paid to expand your bandwidth for acquiring new customers. That can include qualifying leads faster, getting rid of cold leads more quickly, and automating repetitive tasks like answering a customers’ FAQ with live agents.

- Optimize your pricing. An optimal price strategy brings in the most revenue up front, effectively lowering your CAC to LPV ratio. While you can’t legally A/B test your pricing with the same product, you can tweak the offering slightly to offer different price points.

- Optimize your funnel. To ensure your funnel feeds the lowest CAC possible, you first have to understand exactly how it works, with data. A good way to get a handle on your funnel’s workings is with the Brian Balfour Growth Framework.

- Implement CRM. Using a CRM won’t directly lower your CAC. That’s because customer retention has nothing to do with acquisition cost. That said, using a CRM tool will free up resources to let you connect more effectively with more leads per cycle.

Key Takeaways

Understanding customer acquisition cost is key to scaling up a business. But CAC remains a muddy metric for some, leading them to make terrible spending decisions. The main idea is to hold your CAC to ⅓ your LTV—or the lifetime value of each customer.

- A CAC of ⅓ to 1/5 of LTV is ideal.

- The longer you keep customers, the lower your CAC to LTV ratio, but figuring on LTV longer than one year will lead to increased needs for up-front capital.

- Figure at least 90 days of marketing costs into your customer acquisition cost.

- Include a portion of your operating costs in CAC.

- Don’t include the portions of your sales & marketing costs in CAC that don’t drive new customer growth. For example, CRM tool costs should not be part of CAC.

- Lower your cost to acquire new customers by responding faster, raising conversions, and lowering live team costs.

Still have questions on how to calculate customer acquisition cost? Not sure what ratio of LTV to CAC to target? Give us a shout! We’d be happy to discuss.